Big Tax Savings

Deduct qualified equipment costs from your 2025 gross income with Section 179.

Consult your tax professional for more information.

Limits & Savings

2025 Deduction Limit for Businesses = $2.5 Million

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2025, the equipment must be financed or purchased and put into service between January 1, 2025 and December 31, 2025.

2025 Spending Cap on Equipment Purchases = $4 Million

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar-for-dollar basis. This spending cap makes Section 179 a true small business tax incentive.

Bonus Depreciation: 100% for 2025

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment.

Section 179 can change each year without notice (Section 179 has even changed mid-year), so it benefits you to take advantage of this generous tax code while it's available.

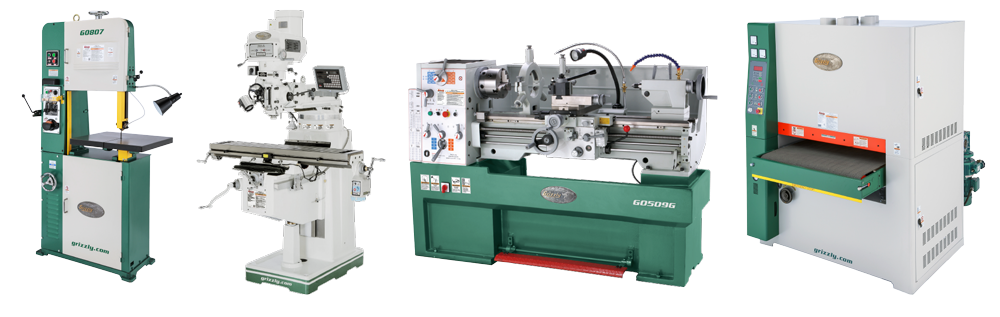

Section 179 offers small businesses a great opportunity to maximize purchasing power. Most of the equipment your business will purchase, finance, or lease qualifies for the deduction (see Section 179 FAQ, linked below), so make sure you do your homework to verify that your company is leveraging the Section 179 deduction this year.

Remember!

You must receive your new equipment before the end of this year to quality for the tax deduction.

Order now to assure delivery in 2025.